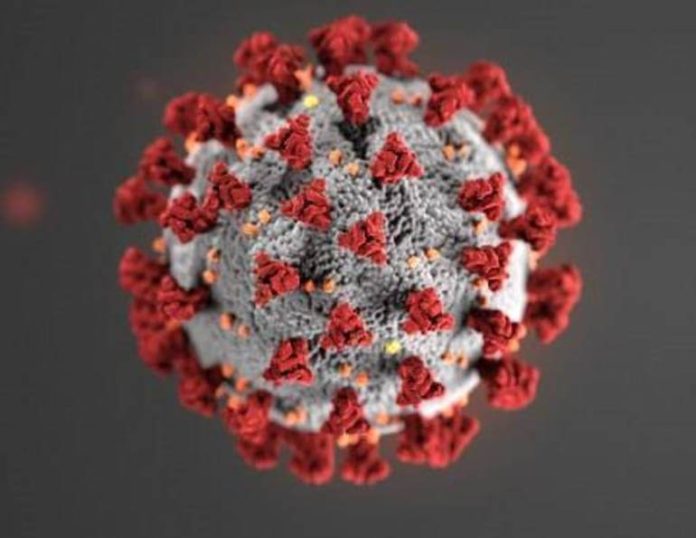

Apple was one of the first major tech manufacturers to warn investors that the coronavirus pandemic would impact its business. What resulted was a mixed bag, with its growing services business helping to offset its struggling hardware operations.

The iPhone maker on Thursday said it eked out a rise in overall sales during its second quarter, alleviating worries that its results would take a big hit amid the spread of COVID-19, the disease caused by the coronavirus. Still, sales weren’t as strong as Apple had earlier expected, and the company didn’t provide guidance for the current period, indicating it doesn’t yet have a handle on the full impact the disease may have on its business.

Apple‘s hardware operations have suffered more than other parts of company as the coronavirus has moved across the globe. In February the company warned that COVID-19’s spread in China would hurt its flagship iPhone business, limiting both supply and sales of the devices. Fiscal second-quarter iPhone sales ultimately dropped 6.7% from a year ago, to $28.96 billion. Sales of Macs and iPads also fell in the March period, down 2.9% and 10%, respectively.

Apple’s services and wearables segments, which include Apple Arcade and AirPods, notched all-time and quarterly records, respectively. As more people sit at home, they’re seeking out services like Apple TV Plus and buying more games in the App Store. Services revenue jumped 17%, to $13.3 billion, while sales from wearables, home and accessories soared 23%, to $6.3 billion.

“When you consider all the ways COVID-19 has touched Apple, our customers and the way we work, this may not have been the quarter it could have been absent this pandemic,” Apple CEO Tim Cook said Thursday during a call with analysts. “But I don’t think I can recall a quarter where I’ve been prouder of what we do, or how we do it.”

Apple’s earnings report is just the latest example of how the coronavirus pandemic has ravaged the world economy. COVID-19 has killed more than 230,000 people worldwide and infected more than 3.2 million. More than 30 million Americans have filed for unemployment, and the US economy shrank nearly 5% between January and March.

In February, Apple warned that the COVID-19 outbreak in China would cause it to miss its projections for revenue in the March quarter. Its devices are assembled in China, and factory closures hurt its ability to ship orders to customers. Cook on Thursday said production has returned to normal.

“While we felt some temporary supply constraints in February, our operations team, suppliers and manufacturing partners have been safely returning to work, and production was back at typical levels toward the end of March,” Cook said.

Along with production, Apple has been affected by lower demand for its gadgets. It’s closed all its stores outside Greater China and has moved its Worldwide Developers Conference, typically held each June, online. The event, one of its biggest of the year, is where the company introduces its newest software features for its iPhones, Macs and various other devices. Apple has also helped health workers and others through the crisis, donating millions of dollars, more than 30 million masks and 7.5 million face shields to help combat the coronavirus.

Apple said it’ll likely see a rebound in Mac and iPad sales soon as people seek out new devices for working at home. The company in March released a new MacBook Air and an updated iPad Pro with new Magic Keyboard. In the past couple of weeks, the company said, it’s seen an overall rebound in sales.

“Over the long term, though, we have a high degree of confidence in the enduring strength of our business,” Cook said.

Phone woes

The coronavirus has been hitting other companies in the tech industry. Phone sales this year are expected to drop to their lowest level in a decade as consumers hold off on purchases.

Samsung on Tuesday said it expects near-term phone and TV sales will “decline significantly” because of store closures and other economic issues related to the coronavirus. Qualcomm, the world’s biggest maker of wireless chips, warned on Wednesday that it expects a steep drop in global phone shipments, but it did see some bright spots. 5G phone shipments should be just as strong this year as the company earlier predicted, and most handset makers are on track with their launches.

Apple, meanwhile, sees promise in its growing wearables and services businesses, as well as its traditional hardware businesses as more people work remotely. Cook said Apple is “looking at other areas” where the company’s products can be used for health monitoring, particularly following the onset of the coronavirus. Cook also said the Apple Card’s new iPhone payment plan, allowing people to pay for a new iPhone over 24 months with no interest, will expand to other products, though he didn’t say which ones.

“You’ll see something on that shortly,” Cook said.

All told, Apple tallied a profit of $11.2 billion in the second fiscal quarter, down from $11.6 billion a year ago. Its per-share earnings rose to $2.55 from $2.46, though, helped by fewer shares outstanding. Analysts polled by Yahoo had expected earnings of $2.28 per share.

Apple’s revenue climbed less than 1%, to $58.3 billion, during the second fiscal quarter, which ended March 28. A year earlier, it reported sales of $58 billion. In January, Apple had projected revenue of $63 billion to $67 billion, higher than Wall Street estimates at the time. Cook on Thursday said that before the coronavirus caused lockdowns and factory closures in China, Apple had been “headed toward a record second quarter, at the very high end of our expectations.” Analysts polled by Yahoo Finance most recently expected Apple to report revenue of $54.7 billion.

Analysts had been “anticipating a horror show for the quarter in light of the COVID-19 pandemic,” Wedbush analyst Dan Ives said. “In light of the COVID-19 pandemic, a global lockdown, with stores closed across the globe, we would characterize these results as a major feat in a dark storm.”

Apple shares, which have been essentially flat so far this year, fell 2.5% to $286.55 in after-hours trading after rising 2.1% during the regular session. The company is valued by investors at nearly $1.3 trillion.